-40%

Forex Secret WD Gann Professional Overlays Square of Price Calculators

$ 5.28

- Description

- Size Guide

Description

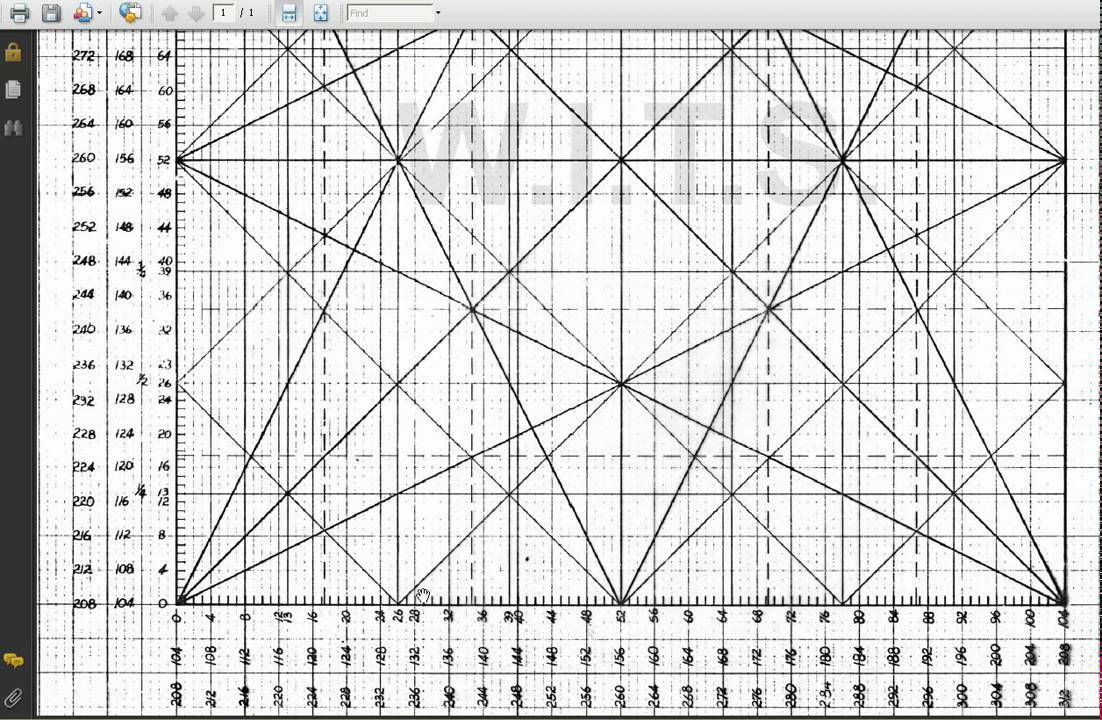

Includes:Square Of 90

Square Of 52

Square Of 144

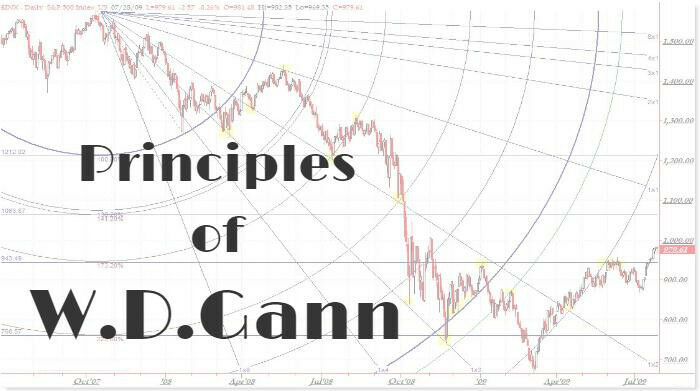

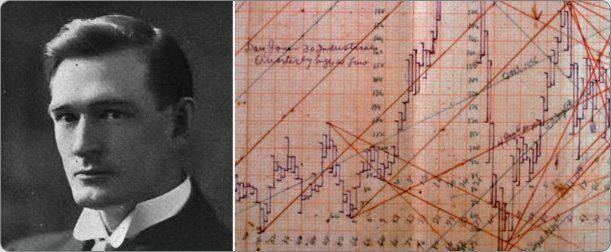

If you have been studying and practicing technical analysis for a while now, you must have heard or seen the name of W.D. Gann. Even your list of indicators will have the name of Gann at least once. Well, who was Gann? Why is he sought out even after 60 years of his death? Let us find out.

WD Gann was born in June 6, 1878. As a finance trader, he started his

work with understanding

Angles, Circle of 360, Square of 9, Hexagon and many others. Most of his works are based on astronomy, geometry, astrology and ancient mathematics. Most of these were so powerful, that they are used widely by traders even today.

With What you are getting is Three WD Gann Original Square of Calculation or Calculator Graphs. Very rare these days I started using Gann's teaching about 10 years back. I received these from a good group that followed his teachings back in 2007. Now I want to give this great chance to understand his teachings to someone else.

Among the many indicators and technical tools, WD Gann laid down some basic rules to be followed for trading: –

If the high price of the entire week is achieved on Friday, expect higher prices next week.

If the low price of the entire week is achieved on Friday, expect much lower price next week.

In a highly uptrending market weekly low’s is achieved on Tuesday.

If market is in strong down trend (if main trend is down), the weekly highs are generally achieved on Wednesday.

When the price crosses the high of the last four weeks, it’s an advance indication of more higher prices.

When the price breached the low of the last four weeks, it’s an advance indication of more lower prices.

In an up trending market if the prices breaks the 30 DMA & remain below it at last for 2 consecutive days, it tells us of a much more great correction (vice-versa).

If the market rises for 5 consecutive days, there is a high probability that correction will be last for 3 days. (Ratio is 5:3).

When the price starts rising from a particular level, Rs.100 or 100% rise whichever is earlier becomes a strong resistance.

When price crosses the high of the last 3 days it tells us about much more higher prices on the 4

th

day. (Traders can buy it on the 4

th

day and place a SL order Rs. 3 below the last 3 days high) (vice-versa).

If subsequent correction is greater than the previous correction both in terms of price & time magnitude, this is an advance indication that trend is changing.

50% of the last highest selling Price is the strong support area. Any stock which is trading below this 50% level is not the useful for investment.

If a price is rising for 9 consecutive day’s at a stretch, then there is highly probability for a correction for 5 consecutive days. (Ratio is 9:5)

Don’t ignore a double bottom & triple bottom signal on a monthly chart, after a minimum gap of 6 months. ( advance indication for mid term investment)

Don’t ignore a double top & triple top signal on a monthly chart, after a minimum gap of 6 months. (Not the right place for investment / entry, price may fall).

When price is in a choppy phase, or in a consolidation phase, if a sudden volume spike found there, it’s an advance indication that trend likely to change.

In a quarterly time frame, when a particular stock crosses the high or low of the last quarter (in the quarterly chart) it’s should be consider as an early indication that the underlying trend trying to reverse.

Shipping

WD Gann Trading Overlays Will Be Delivered To Your

PayPal

Email To download After Purchase. I'll do My Best to Get That E-mail to your inbox in 24 hrs.

If By chance you don't have

PayPal

. Send me a Sellers Note with Your E-mail For Receiving The Trading Overlays during your Purchase.