-40%

The Greatest Bull Market in History (Martin Armstrong) Study of World Economy

$ 105.07

- Description

- Size Guide

Description

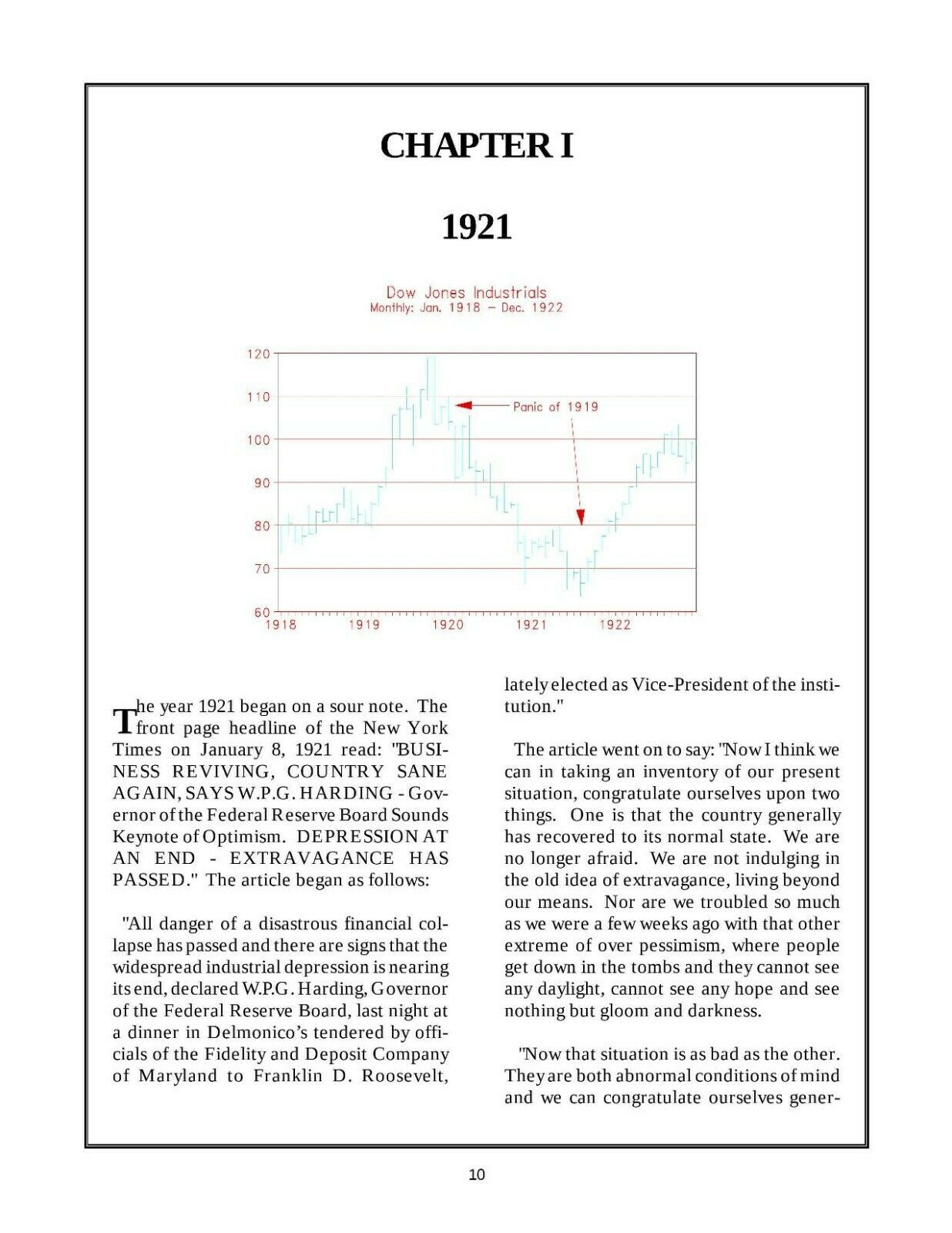

The Greatest Bull Market in HistoryHardback version selling for as much as ,000 on Amazon and eBay

This is the only complete and authentic listing for this product available anywhere on the internet

Forbidden knowledge actively Banned by the U.S. government and American as well as international media conglomerates. The Economic Confidence Model is an Ai generated predictive program that the United States CIA unsuccessfully attempted to seize from Mr. Armstrong under very forceful terms over a decade ago. See the movie The Forecaster (starring Martin Armstrong, a documentary film made Outside of the United States) for more on this which I also have for sale on eBay. Martin was nearly killed by high level operatives but survived a brutal physical attack while imprisoned under false terms due to his very sensitive knowledge regarding illegal elite insider financial activities and the Russian election which put Putin in power. Martin was also unwilling to join the "club" and rejected proposals made to him when he was an active trader and international asset manager.

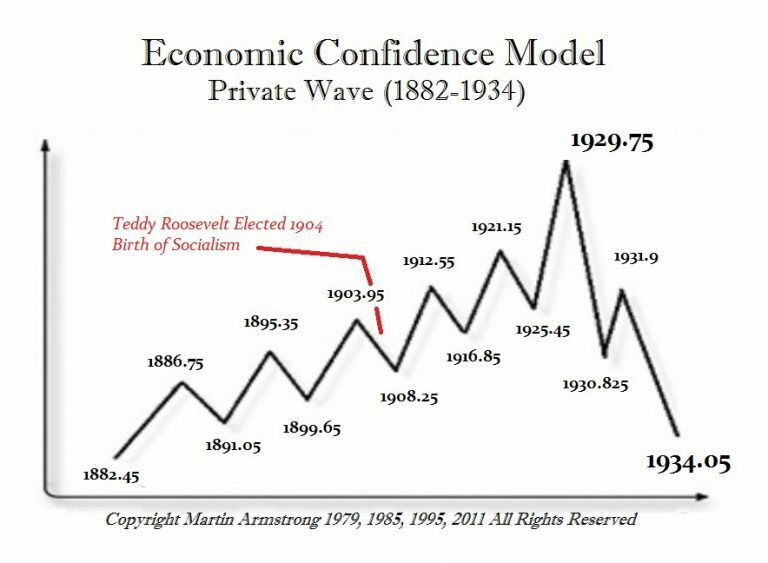

The ECM confirms a hidden order (via mathematics, Pi specifically) amidst the perceived chaos and complexities concerning mass societal behavior among the human species as well as within Nature. Capital flow movement is also an important part of the model. Everything in this dimension of spacetime has a CYCLICAL PATTERN including organic life, collective human behavior, planets and stars.

The 8.6 year business cycle is paramount at 3,141 days or Pi.

NOTE: The current virus health scare has positioned the U.S. stock markets to transfer the Energy needed for the ultimate SLING-SHOT move to Dow 40k and beyond. The current correction is Necessary and Healthy to exact the future move higher. Institutional capital has nowhere else to hide as the current monetary system collapses. Puplic debt markets are no longer a salvageable option to park capital. Keynesian economics is unraveling before the world's eyes. NATIONALIZATION OF PRIVATE ASSETS IS ALREADY UNDERWAY GLOBALLY (Europe, etc.) Put your stocks in your name, not in street name!

Currently we are in the 6th ECM wave from the beginning of capitalism. This is the stage of government collapse and the subsequent shift of public to fully private investments by the masses. The well informed know that governments are loosing control and power as they stand on their last leg with no ability to solve the incoming global social and monetary crisis. However, the masses still have faith in the system. That foolish and collective faith will dissipate rapidly over the next few years. The United States system will be the last to fall, likely preceded by Japan and Europe. In the end, current financial and social systems as they exist today in developed economies will Not exist in a few years from now as we move through the tail end of the 4th turning.

Martin's ECM blog is read by all the high-level intelligence agencies in the USA and China. The ECM is also used by elites such as central bankers, captains of industry, international investors as well as other high level insiders as a navigational tool and investment guide, etc.

The Database. Construction of his database cost Martin Armstrong in excess 0 million. It took that much money to accurately recreate the economic crash of the Roman Empire. He was interested in how quickly the end actually came. For this, Armstrong had to track down and buy all relevant and available coins. Based on the falling gold content of the coins, he thought he could find out how quickly Rome actually fell. He developed the “Pi Code”, which many experts still consider to be a kind of global formula. It shows what makes the world economy tick and reveals the eternal ups and downs of the economies. In fact, Armstrong has already predicted crises to the day. For example, he predicted "Black Monday" in autumn 1987, the first stock market crash after the Second World War. Armstrong also unequivocally announced the historic Nikkei descent in 1989 and the Russian crisis in 1998.

The key to creating such a computer system was massive and comprehensive data. Martin put together perhaps the most comprehensive collection of monetary instruments from every society on a global scale to map out the trends. He has also included nature, storms, earthquakes, climate changes (cyclical), and the rise and fall of populations, as well as war. Bringing together so much data cost far more than most of the NY banks’ research budgets combined for decades, and this has enabled him to see that we do reach periods of tremendous concentration of trends — the rogue wave that appears out of nowhere in economics just as it does the oceans of the world. They are caused by the synchronization of many trends suddenly coming together to produce a giant wave that conforms to what people call Murphy’s Law, whereby whatever can go wrong, goes wrong all at once. This is what we face about once every

300

years.

*For your Attention. This posting is for access to the greatest modern book ever completed on historical finance. Available in secure and virus-free electronic watermarked form (pdf file).

This is a digital collection. No physical volumes will be sent.

This is the ONLY GENUINE COPY available on the internet. Others are fraudulent. Check my feedback!

Extremely difficult to acquire in the free market (unless willing to part with thousands) as physical copies bring in prices starting at ,000 usd. 574 pages (confirmed) including preface section.

Direct quote from Martin Armstrong: "Unfortunately, the book I wrote back in 1986, “The Greatest Bull Market in History,” brings as much as ,000 on eBay. Paul Tudor Jones had bought a large quantity and distributed them to his clients so that is probably where most have survived. I have only one copy myself. The receiver confiscated all the copies to prevent them from getting out, I believe, at the request of the Commodity Futures Trading Commission."

From this book: The key to the FUTURE lies in understanding the PAST.

00 on Amazon currently (hardcopy)

newyorker.c0m/magazine/2009/10/12/the-secret-cycle

The majority are Always wrong (mostly about everything). Trade accordingly. The keys are Confidence and Capital Flows. Why are they wrong? Because there exists a COMPLEX societal economic system with numerous variables all interacting simultaneously. Some relationships will be present and then vanish in certain or comparable economic environments due to these complexities.

We all operate under the veil of ignorance but the ECM opens a window to clarity.

This book (in pdf file format) is an INVALUABLE INFORMATION and REFERENCE TOOL.

Please send your email address (as a note in the paypal payment message section) so that I may send you the secure watermarked pdf file direct.