-40%

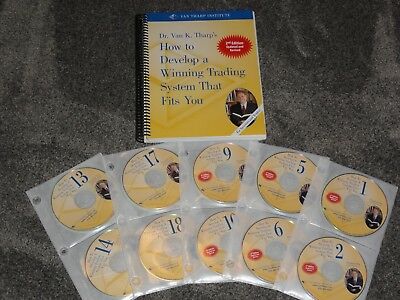

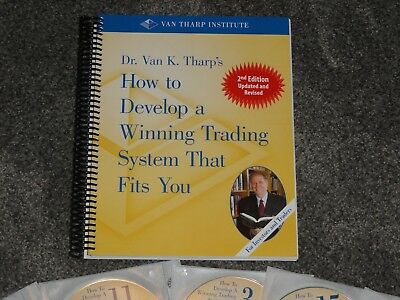

Van Tharp How to Develop Winning Trading System that Fits You 2018 NEW with Book

$ 118.8

- Description

- Size Guide

Description

Van Tharp - How to Develop a Winning Trading System that Fits You 2018I purchased this course in March 2018. Paid 5.

20 Audio CD and Book. This is the latest and newest version book.

Book is Super Clean and has no writings at all in the book!

I will also include a protective case to store all the CDs as a free bonus.

This 20 CD set and book is very heavy to ship. Almost 4 lbs!

This Systems Development course will help you develop your own trading system, as well as, get a better understanding

of how to make more profit while trading any market under any conditions.

Gain all the benefits from Dr. Van Tharp's years of modeling traders and his research on how profitable trading systems are

developed. His conclusion from this research is that average person doesn't have a chance at profitable trading because he

or she concentrates on all of the wrong things.

You won’t learn this information watching the financial news, reading financial magazines, or reading the mainstream financial

newspapers, because the media will totally ignore the most significant aspects of system development.

This program helps you determine what type of trading system will suit you personally and how to create it. Learn little-known,

closely-guarded secrets that are not published in books and that you’re not likely to find unless you accidentally stumble upon them.

What's Included in the Audio Program

This program has 20 audio CDs: 11 CDs of newer material and 9 CDs from the classic home study course covering information no longer taught in our Systems Development workshop.

This audio program was recorded live from two separate workshops. It contains a complete three-day workshop taught exclusively by Dr. Van Tharp and covers little known secrets for developing customized, winning trading systems. This is timeless information and therefore it is not linked to any particular market or timeframe.

We also retained sections from the original systems development recording from years back because this original section contains material that is no longer covered in the workshops and can only be found on this audio program.

Many of our clients listen to these CDs over and over and over again just to get all the subtle details they sometimes miss on the earlier reviews.

Material covered includes the psychological pitfalls of system development, understanding that you only trade your beliefs about the market and not the market itself, and key concepts of system development including some of Dr. Tharp’s trade-mark concepts—expectancy, R-multiples™, System Quality Number® score and position sizing™ strategies.

You will learn trading concepts that actually work in areas such as trend following, band trading, value trading, mental scenario trading, seasonal tendencies, spread trading and arbitrage.

Among many other things, this program will familiarize you with the key parts of a system, give you good examples of each part, and help you develop appropriate setups, and an appropriate entry and stop loss.

Course Objectives

To familiarize you with the psychological pitfalls of system development. At the very least, it’s critical that you understand that you only trade your beliefs about the market, not the market itself.

To help you understand the key concepts and steps in system development, including expectancy, R-multiples, system quality and position sizing strategies.

To help you understand the power of objectives and how objectives influence your results, to give you practice strategizing with some objectives in our simulations, and to help you understand what is required of system development objectives. If you understand the power and importance of objectives and use this sort of strategizing to meet them, your whole approach to system development will change.

To help you understand some of the key concepts that you could trade that actually work:

Trend following, especially trends based upon fundamentals.

Band trading.

Value trading where value is defined as buying things at pennies on the dollar.

Mental scenario trading.

Seasonal tendencies when these are "real" and not statistical abnormalities.

Spread trading and arbitrage.

To help you define "R" in your trading and develop appropriate setups, entry, and a stop loss.

To familiarize you with the key parts of a system and give you good examples of each part.

To help you decide what criteria you might have to meet before you are willing to trade a system. These are going to be based upon your own values, not someone else’s.

To make you more familiar with the key to meeting your objectives—position sizing strategies—so that you have a good chance of meeting your objectives.

To teach you how to determine the quality of your system is whether it is a Forex day trading system or a stock value investing system.

What Kind of Trader Are You?

Are you a low-risk investor who just wants to make small, consistent profits each month with only an occasional loss?

Learn how to develop a system that will allow you to develop a unique methodology that will give you that kind of consistency!

Are you a gutsy trader who’d like to make yearly profits of 100%, 200% or even 1,000% per year?

It’s possible, although risky, and you can learn that, too. The interesting thing is that you can do it in such a way that the only money you are risking is the money you’ve already made from the market. That’s real leverage!

Only about 5% of the world’s traders and 10% of the world’s investors, consistently make big money. What these winners do is not complex. In fact, simplicity is one of the keys to making money. And you can do it too! I’ve modeled this process and can teach you how to develop your own trading system that fits your own style of trading.

Why develop my own system? Isn’t it easier to just go buy a system with proven results?

There are hundreds, if not thousands, of trading systems that work. But most people, after purchasing a pre-existing system, will not follow the system and trade it exactly as it was intended. Why not? Because the system doesn’t fit them or their style of trading.

One of the biggest secrets of successful trading is finding a trading system that fits you. In fact, Jack Schwager, after interviewing enough “market wizards” to write two books, concluded that the most important characteristic of all good traders was that they had found a system or methodology that was right for them.

When someone else develops a system for you, you don't know what biases they might have. But when you develop your own system, it will be compatible with your own beliefs, objectives, personality and edges. And that will make it much easier for you to trade.

Furthermore, most of the system development software currently available promotes trading biases that can be detrimental to overall trading success. Most system development software is designed because people want to be able to predict the markets perfectly. As a result, you can buy software now for a few hundred dollars that will allow you to overlay numerous studies over past market data. Within a few minutes, you can begin to think that the markets are perfectly predictable. And that belief will stay with you until you attempt to trade the real market instead of the historically optimized market. Many trading accounts have plummeted from this very thinking. One “sure-thing” trade placed without proper position sizing can wipe some traders completely out of the game.

Our job in this course is to teach you what you need to know to develop your own system. The material you will learn is not market or time-frame specific. So whether you trade stocks, futures, currencies or gold, etc., or whether you place 50 trades per day or 50 trades per year, you will learn all of the components that work in any system.

Three Critical Secrets You Can Adopt to Develop a Superb Wealth-Building Formula

Developing Sound Objectives

This is the most important task of system development. If you do this one task properly, it will take at least half of your time during the development process. When you learn what it is, you’ll say, “Of course it’s important!” but you’ll still probably spend very little time on it. To develop a system that fits you, you need to really think about what you want. It’s not a trivial task.

There are at least 30 questions you need to address when you develop a trading system. Dr. Tharp takes you through each question so you’ll know exactly what’s important for you.

10 Key Components

Most people ignore six or seven of the key components of system development when they do their research. In fact, you’ll never see a book on system development that covers more than six of them. That’s the limitation the average trader has in doing research. You want big profits with as little risk as possible, so you want every advantage possible when you start to develop such a system.

You should be able to take advantage of eight of these components easily after hearing these CDs. And, with a little more effort, you’ll be able to use all 10. If you use all 10 components with competence, you’ll be among the top one tenth of one percent of all traders and investors in the world.

Position Sizing Strategies

Most people concentrate on entry—the least important element in system development. And they ignore position sizing strategies—the most important element. Through this home study course you will learn position sizing algorithms that peak performers use. In addition, you’ll learn position sizing algorithms that will help you lower your overall risk, while at the same time, helping you achieve more consistent performance.

If you concentrate on these three secrets—which 95 percent of all traders and investors totally ignore—you can vault yourself into a class that only a few have been able to achieve.

If you’re more adventurous, we’ll show you how to really go for really big returns using the market’s money. When you use these super money making techniques, you could make 1,000% on your money each year, risking mostly the money that the market has given you.

You’ll learn the secret behind how one trader turned ,000 into .1 million in less than a year. He traded a volatility breakout system, but the key to his profits was his position sizing method.

In addition, we’ll also show you how another group of traders has taken over 0 million out of the market over the last 10 years! They traded a channel breakout system, but the real key to their success was the money management. Learn the advantages and disadvantages of both these styles. This sort of adventurous trading is very risky. You could lose a substantial amount of money if you’re not careful. As a result, we’ll show you all the pitfalls so that you thoroughly understand the risk involved.

Ten Money Making Secrets You Will Learn

1 - Get specific ideas for making better market entry and exit decisions.

2 - Learn specific position sizing ideas from the author of the

Definitive Guide to Position Sizing

.

3 -Be introduced to the psychological pitfalls that hold back so many people. Just knowing about them will help you avoid them.

4 - Work through Dr. Tharp’s model of how to design, develop, and customize a trading system.

5 - Learn new approaches to the markets and new techniques for analyzing them.

There are 15 concepts behind most trading systems. Most concepts, even the most popular ones, are meaningless. But you’ll learn about ones that work best.

6 - Receive practical trading ideas.

7 - Be introduced to a random-entry trading that earns between 0.5 percent and 11 percent per year on various historical tests.

8 - Better understand how expectancy is shaped by your exits from the market.

9 - Use the System Quality Number score to compare day trading systems in one market to long-term investing systems in another.

10 - Fifty percent of system development is designing sound objectives. You’ll hear ideas on how to develop sound trading objectives.

Access to the Experts

Imagine being in a room full of professional traders and investors. Each of them controls at least ,000,000 in trading funds. Some of them control over a billion dollars. And these top traders and investors are gathered together to help you develop the perfect trading system for you!

What if you could ask them any questions you wanted and they would give you honest, straightforward answers? Think about all the secrets you’d learn.

What would happen to your profits if you applied that material and used it to develop a system that was perfect for you and your personality? The results would be incredible.

It sounds great, but how could you meet all of these top traders and professionals? And if you did, how would you know what to ask them? Would they tell you the truth?

You can have the same experience with this home study course! Market Wizard Trading Coach, Dr. Van K. Tharp, has done the work for you! Dr. Van K. Tharp is a very consistent, astute, and systematic researcher of human behavior. He has personally interviewed hundreds of top traders to determine what makes them excel in their profession and collected psychological profiles from over 5,000 traders and investors.

With this information, he carefully crafted a model that people like you can adopt to improve your own skills.

“If one person can achieve great success, then that skill can be taught to others—in fact, to almost anyone. I’ve proven this formula in helping to develop top traders and investors. Now, I want to offer you the same incredible opportunity to make big money.”—Van K. Tharp Ph.D.

Is This Study Program Right For You?

Are you willing to roll up your sleeves and work at designing objectives and risk parameters for yourself? If you are, and you’re willing to apply the principles we teach you, you’ll love this home study.

We’ll teach you how to use all the system building blocks to design a trading system so that you’ll end up with a system that’s just right for you! In the process of learning how to do this, you’ll probably come up with dozens of winning systems that will work because they’ll be based on criteria that fit your situation. Remember, we do not give you a system that has already been developed. That would defeat the whole idea of developing a system that fits you. This audio series is about giving you the tools you need to design your own system.

What the Home Study Program Is Not

Developing a trading system encompasses many parameters including the capital you have available, the type of markets you’re trading, the type of money management rules you are applying to your trades, your psychology, and other resources which are available to you. Our audio series is comprehensive in that it discusses each of these aspects.

However, it is not a step-by-step program focusing on a particular type of trading system. That would defeat the purpose of the course—only you can decide what’s right for you based upon your specific objectives. We don’t give you specific trading systems. Instead, we give you trading ideas that make a lot of money and we show you how to adapt them to make them your own. And we do it because that’s the only way you’ll ever trade it. When you understand that, you’ll be on your way towards developing an ideal system for you.

Dr. Tharp Has Done the Hard Part for You

So much of the research has been done for you. Think how much time, energy, and money you can save by focusing on the more important aspects of trading system development and Dr. Tharp’s model. Most of you will probably save thousands of dollars, which is many times the cost of the program. Most traders who are really committed to doing research will probably spend a significant amount of money and time just to find the same information, which will be presented in this program. Some traders have invested more than a million dollars in research to arrive at the conclusions you’ll find in this program.

Below are some common questions we received about this home study:

Q: I am interested in this home study because I want to calculate the SQN of my systems. Will this course give me information on SQN?

If you want to understand the System Quality Number

TM

(SQN

TM

), please consider reading the Definitive Guide to Position Sizing Strategies or attending either the Blueprint Workshop or the Systems Development Workshop. Our systems home study course has little information on SQN related topics compared to the extensive information you will find in the Definitive Guide book and the Blueprint or Systems workshops. We will soon release a home study course focusing soley on SQN.

Q: I want to understand how to backtest my system. Does this course address backtesting and if so are there recommendations on software that does that well?

Dr. Tharp places little value for traditional back testing methods as promoted by platform vendors. Instead, he prefers that traders work on understanding all of their beliefs relating to a trading system - why a system should work and how it should perform in various market types. The more you understand about your trading system, the less testing you will need to do. In addition, the best “testing” results come from live trading with very small positions. There are so many assumptions and logic rules built into backtesting software systems that often, live trading results differ quite significantly from backtests – even with the best in data, assumptions, logic, and software.

Q: I want to follow Van’s suggestion and develop systems that fit particular market type. I don't fully understand how to gauge market type. Does this course cover that?

There is some information on market types in this home study course but it is minor compared to the live workshop. In the How to Develop Systems Workshop, we spend significant time on market types and considering what types of systems work well in each market type.

Reviews

“Your system workshop simply changed the way I approach system development… my profits are significantly higher and could have paid my workshop costs ten times since then.”—L.M., Atlanta, GA

“Superb. Every section of the workshop was stuffed with information. I couldn’t take notes fast enough (so I opted to just listen). Lots of creative ideas worthy of further research”—R.W., Superior, CO

“Due to attending your workshop entitled How to Develop a Winning Trading System that Fits You, I have had a radical shift in my perception of how to achieve consistently successful trading.”—M.S., Shropshire, England

“Excellent! I never thought of how many separate elements went into a system. I now have the knowledge and confidence to develop a system for myself.”—B.F., Huntington Station, NY

“Very useful to see first hand the real risks of ruin, over-trading, etc. The workshop was very helpful to me in laying out the specific tasks I must complete.”—B.C., Toronto, Ontario, Canada.

“Having been to all of Van’s workshops on system development, this one was a repeat for me. However, I still gained a great deal from the workshop -- the creative money management strategies section was especially thought provoking. This workshop is a must for any trader, beginner or experienced. Well done Van.”—K.T., London, England